PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

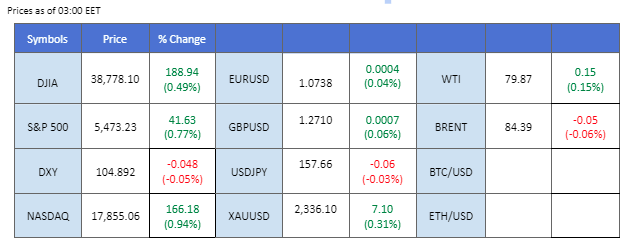

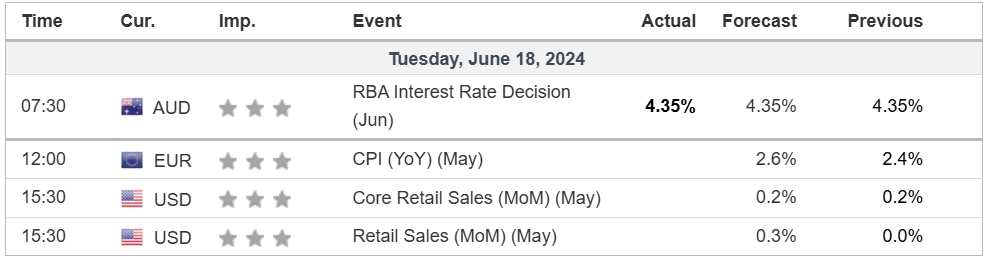

The U.S. dollar is hovering near its recent high levels amid global navigation through Eurozone political uncertainty and the divergence in central bank monetary policies. Besides the U.S. dollar, market attention is focused on the Australian dollar today as the Reserve Bank of Australia (RBA) is set to announce its interest rate decision, with widespread expectations that the RBA will hold the rate unchanged at 4.35%.

Meanwhile, the Japanese yen saw modest gains as the Bank of Japan (BoJ) chief signaled a potential rate hike next month if economic data proves satisfactory. In the commodity market, the strengthening U.S. dollar continues to exert downside pressure on safe-haven gold. Conversely, oil prices jumped to their highest level since June as market optimism about demand outlook increased.

On the other hand, the crypto market experienced a selling spree, with the BTC ETF witnessing an outflow of more than $600 million last week.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.7%) VS -25 bps (8.3%)

(MT4 System Time)

Source: MQL5

The Dollar Index, tracking the greenback against a basket of six major currencies, remained flat as investors awaited several pivotal U.S. economic data releases and events later this week. Attention is focused on the upcoming U.S. retail sales data, with economists predicting a 0.30% month-on-month increase. Following the release of recent U.S. CPI, PPI, and jobs reports, consumer spending indicators are now central to gauging the Fed’s next moves on interest rates. Additionally, statements from several Federal Reserve officials expected later this week are highly anticipated by global investors, as these could provide further insights into the Fed’s policy direction

The Dollar Index is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 105.65, 106.35

Support level: 105.15, 104.45

The gold market remained flat, struggling to find clear direction due to a lack of catalysts from the U.S. market yesterday. As the week progresses, investors will focus on upcoming U.S. economic data and statements from Federal Reserve members for trading signals. Despite recent U.S. economic data largely underperforming expectations, hawkish comments from Fed officials have limited gains in the gold market. Investors are keenly observing these developments to better understand the potential impact on gold prices and to gauge future market trends.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2330.00, 2360.00

Support level: 2295.00, 2265.00

The Pound Sterling continued to trade weakly against the strengthened dollar, lacking a catalyst compared to the U.S. dollar. However, the UK’s CPI reading, due tomorrow, might stimulate the Sterling’s strength if it surpasses market expectations. Additionally, the market is closely watching Thursday’s Bank of England (BoE) interest rate decision, with widespread anticipation that the UK central bank will keep the rate unchanged.

GBP/USD is trading to its monthly low levels with the heightened bearish momentum. The RSI has been hovering in the lower region while the MACD edge is lower after breaking below the zero line.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2540

The EUR/USD pair continues to face strong downside pressure as the euro encounters multiple headwinds. The European Central Bank (ECB) has pivoted its monetary policy, becoming one of the first central banks to start easing in the region, which has weighed heavily on the euro. Additionally, the French snap legislative vote has cast a shadow over the region’s political stability, exerting further pressure on the euro.

EUR/USD has formed a lower low and lower high price pattern, suggesting a bearish signal for the pair. The RSI has once again approached the oversold zone, hovering below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.0805, 1.0860

Support level: 1.0660, 1.0615

The U.S. equity market, particularly the Nasdaq and S&P 500, continued to hit record highs as technology shares extended their bullish momentum driven by AI hype. However, the market might face significant volatility ahead of crucial U.S. economic data releases and Federal Reserve officials’ speeches, which could impact monetary policy decisions. Mega-cap stocks like Apple and Microsoft rebounded from early losses to end 1.97% and 1.31% higher, respectively. The sustainability of the rally in AI-related shares may hinge on the Fed’s monetary policy stance. If Fed officials signal dovish tones, leading to a drop in U.S. Treasury yields, the equity market could find further support.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 83, suggesting the index might enter overbought territory.

Resistance level: 20125.00, 20650.00

Support level: 19710.00, 19390.00

The Japanese Yen recorded a modest gain against its peers as the Governor of the Bank of Japan (BoJ) signaled that the central bank might raise interest rates if the economic data proves optimistic. Wage growth in Japan underpins consumption, which may spur inflation and enable the central bank to further lift interest rates. This potential policy shift could result in further strengthening of the Yen.

USD/JPY has broken above its strong liquidity zone, suggesting a bullish signal for the pair. The RSI remains in the upper region, while the MACD continues to edge higher, suggesting that bullish momentum is gaining.

Resistance level: 158.45, 159.50

Support level: 157.05, 156.10

Oil prices rebounded yesterday despite a lack of significant headlines. Analysts attribute the bullish sentiment in the oil market to expectations that global central banks will likely cut interest rates soon, potentially boosting economic momentum and increasing demand for oil. Positive forecasts from OPEC and the International Energy Agency (IEA) have also sustained the upward momentum. The overall bullish outlook for oil is underpinned by these organisations’ projections of increased demand, contributing to the market’s optimism.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 79.85, 81.85

Support level: 78.45, 77.10

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!