-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

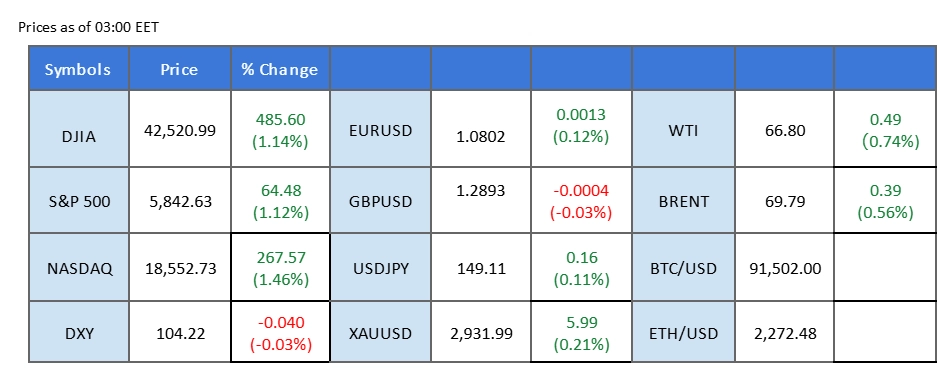

Market Summary

Wall Street snapped its week-long losing streak, staging a technical rebound in the last session, with the Dow Jones reclaiming the 43,000 mark. The recovery came after former U.S. President Donald Trump announced a delay in auto tariffs on Canada, though reciprocal tariffs are still set to take effect on April 2. The Canadian dollar found relief from yet another policy reversal by the Trump administration, with the USD/CAD pair posting its second consecutive daily decline as the greenback softened.

In the European market, the euro surged to its highest level since last November, with EUR/USD rallying sharply. The main catalyst behind the euro’s strength was a selloff in German Bunds, as markets reacted to expectations that the newly elected German Chancellor will push through a major government spending package focused on infrastructure and defense. The resulting spike in Bund yields fueled expectations of higher interest rates, driving the euro higher.

Gold prices held firmly above the $2,900 mark as uncertainty in the broader financial markets persisted. Should the U.S. dollar continue to weaken, gold could extend its gains in the near term. Meanwhile, oil prices remained subdued, with WTI trading below the $70 level, as Trump’s aggressive trade policies cast a shadow over global demand expectations.

In the crypto space, volatility remained elevated as macroeconomic factors continued to shape risk sentiment. However, the delay in auto tariffs on Canada helped to stabilize market sentiment, lifting Bitcoin (BTC) above the $90,000 mark in the last session.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

Despite a series of stronger-than-expected U.S. economic reports, the U.S. dollar continued to weaken as market participants expressed doubts about the sustainability of U.S. economic growth. Many global economies are adopting aggressive stimulus plans to accelerate recovery, raising concerns that U.S. tariff policies may not provide similar short-term benefits. Additionally, the potential for retaliatory trade measures and ongoing discussions around de-dollarization further dampened sentiment toward the greenback.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 106.40, 107.60

Support level: 105.45, 104.45

Gold prices have surged past the $2,920 resistance level, signaling a strong bullish breakout. The precious metal remains in high demand as market uncertainty intensifies following the Trump administration’s aggressive trade policies against key U.S. trading partners. Adding to the risk-off sentiment, geopolitical tensions in Europe continue to weigh on investor confidence. Germany is set to pass a significant defense spending bill, reflecting growing concerns over the prolonged Ukraine-Russia conflict. With safe-haven demand on the rise, gold prices are likely to remain well-supported in the near term.

Gold prices have broken above the price consolidation range, suggesting a bullish signal for the pair. The RSI remains elevated, while the MACD has broken above the zero line, suggesting that gold remains trading with bullish momentum.

Resistance level: 2955.00, 3000.00

Support level: 2900.00, 2875.00

USD/CAD,H4

The Canadian economy received a boost after President Trump announced a one-month delay in auto tariffs on Canada, providing a temporary reprieve for the country’s auto sector. The extension eased trade concerns, fueling a rebound in the Canadian dollar. Meanwhile, the U.S. dollar remained lacklustre, contributing to further downside pressure on USD/CAD. The pair has dropped more than 1% from its peak on Monday, as investors recalibrate expectations amid shifting trade policies and broader market uncertainty.

USD/CAD is trailing lower and has reached a new low this week, suggesting a bearish bias for the pair. The RSI continues to slide while the MACD is poised to break below the zero line, suggesting that bearish momentum is forming.

Resistance level: 1.4355, 1.4460

Support level: 1.4265, 1.4155

The USD/JPY pair is hovering near its recent low, with the 149.0 level serving as a key short-term support. A break below this threshold could signal further downside for the pair. The sharp rise in Japan’s 10-year bond yield—surging above 1.5% for the first time since 2009—reflects growing market expectations that the Bank of Japan (BoJ) will raise interest rates this month. The prospect of tighter monetary policy has fueled demand for the yen, adding to the downward pressure on USD/JPY.

The pair remain trading in a lower-low price pattern, suggesting a bearish bias for the pair. The RSI has been flowing at below the 50 level while the MACD is flirting with the zero line, suggesting that the pair remain trading with bearish momentum,

Resistance level: 149.50, 151.30

Support level: 147.00, 143.80

The euro strengthened, driven by expectations of large-scale fiscal stimulus in the region. European markets reacted positively to the U.S. decision to pause military aid to Ukraine, a move that eased some geopolitical uncertainties. The European Commission’s decision to trigger national escape clauses from the Stability and Growth Pact could unlock €650 billion in national spending, alongside additional measures totaling €800 billion. Furthermore, Germany’s agreement to suspend its debt brake and introduce a €500 billion infrastructure fund further bolstered investor confidence in the eurozone’s economic outlook.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the pair might enter overbought territory.

Resistance level:1.0805, 1.0955

Support level: 1.0670, 1.0525

HK50 soared as Chinese authorities committed to robust stimulus measures aimed at strengthening economic growth. During the National People’s Congress (NPC), China reaffirmed its 5% GDP growth target for 2025 and introduced initiatives to stimulate domestic consumption, including subsidies, pension increases, and financial aid for households. These measures are designed to counter deflationary pressures, a sluggish property sector, and recent U.S. tariff hikes.

HK50 is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 72, suggesting the HK50 might enter overbought territory.

Resistance level: 24915.00, 27770.00

Support level: 22535.00, 19600.00

Crude oil prices retreated amid progress in U.S.-Iran nuclear negotiations and renewed Russia-Ukraine ceasefire discussions. Hopes for a diplomatic breakthrough raised the possibility of sanction relief for Iran, potentially increasing global oil supply and putting downward pressure on prices. However, failure in talks could lead to tighter restrictions on Iranian exports, offering a counterbalance to supply concerns.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 46, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 68.30, 69.30

Support level: 66.75, 65.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!