-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

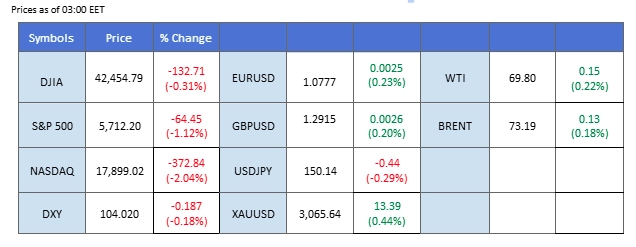

Market Summary

President Donald Trump has announced a 25% tariff on auto imports, a move aimed at boosting domestic manufacturing jobs but one that has rattled financial markets, raising fears of a broader trade war. The aggressive policy shift has fueled concerns over rising inflationary pressures, reinforcing expectations that the Federal Reserve may maintain a tighter monetary stance. As a result, the U.S. dollar surged to a three-week high, benefiting from higher yield expectations.

Wall Street, however, reversed its recent rally, closing lower as risk sentiment deteriorated. The impact extended into Asian equity markets, where most indices opened in negative territory, mirroring the cautious stance among investors. The crypto market, often considered a risk-sensitive asset class, also felt the pressure, with Bitcoin edging lower and Ethereum slipping below the key $2,000 level.

In the oil market, WTI crude is inching closer to the critical $70 per barrel mark, as traders assess the impact of U.S. sanctions on Venezuelan oil exports, which could tighten global supply. However, broader economic uncertainties stemming from Trump’s tariff measures raise concerns over weaker global demand for crude.

Meanwhile, gold prices remain flat, but rising geopolitical and trade uncertainties—particularly with Trump’s April 2nd “Liberation Day” deadline approaching—could support safe-haven demand, keeping gold elevated.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86.4%) VS -25 bps (13.6%)

Market Overview

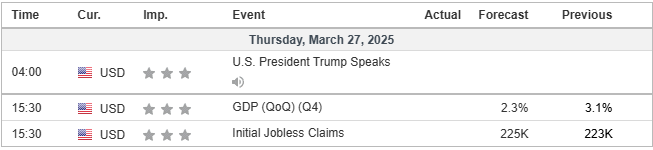

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index rebounded slightly, supported by better-than-expected US economic data. According to the US Census Bureau, US Durable Goods Orders increased by 0.90%, significantly outperforming market expectations of a -1.1% decline. However, long-term dollar direction remains uncertain as investors await Trump’s April 2 reciprocal tariff announcement.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 104.55, 105.90

Support level: 103.25, 101.85

Gold prices found support, as investors shifted toward safe-haven assets following Trump’s auto tariff announcement. Gold tested key resistance levels but remained in a consolidation range, with US trade policy developments likely to influence its next major move.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 3030.00, 3055.00

Support level: 3005.00, 2985.00

The British pound faces volatility ahead of Q4 GDP and retail sales data, key to BoE rate expectations. Strong data could push GBP/USD to 1.3000, while weak numbers may deepen recession fears, dragging it to 1.2875. Cooling inflation (2.8%) supports two BoE rate cuts, but stubborn wage growth may keep policymakers cautious. With a 58% chance of a Fed June cut, Friday’s US PCE inflation adds uncertainty, fueling market swings.

GBP/USD stays under pressure near 1.3000 after breaking its upward trendline, signaling a bearish bias. RSI at 45 shows weak momentum, while the negative MACD reinforces downside risks. Failure to reclaim higher levels could lead to tests of 1.3000 and 1.2875 support. However, a break above 1.3000 may shift sentiment in favor of buyers.

Resistance level: 1.3000, 1.3100

Support level: 1.2875,1.2785

EUR/USD remains under pressure as the Fed’s hawkish tone, weak European data, and looming US tariffs weigh on sentiment. FOMC voter Musalem’s remarks reinforced the need for prolonged high rates, slashing June rate cut odds below 50% (from 70%), strengthening the USD. Meanwhile, Trump’s April 2 tariff announcement poses a major downside risk, with broader EU-targeted tariffs potentially pushing EUR/USD toward 1.0660-1.0710. Europe’s economic outlook remains fragile, as Germany’s €50B stimulus struggles to offset trade shocks.

The pair remains under pressure near 1.0775, extending its downtrend and maintaining a bearish bias. RSI at 41 signals weak momentum, while the negative MACD reinforces downside risks. If selling persists, support at 1.0774 and 1.0727 may be tested. A break above 1.0827 could shift momentum, allowing for a short-term recovery.

Resistance level: 1.0827, 1.0880

Support level: 1.0774, 1.0727

The Swiss franc remains resilient as mounting market uncertainties drive investors toward safe-haven assets. The USD/CHF pair has been consolidating following a technical rebound from its recent low near 0.8765, but the broader sentiment favors further CHF strength. With Trump’s aggressive trade policies heightening global economic risks, market participants may pivot away from the U.S. dollar as a safe-haven play and instead seek refuge in the Swiss franc. Should risk aversion intensify, CHF demand could strengthen further, potentially pushing USD/CHF below its current consolidation range and resuming its bearish trajectory.

The USD/CHF pair is seemingly eased from its rally after performing a technical rebound at its 4-month low level, suggesting a bearish bias for the pair. The RSI remains close to the 50 level while the MACD flows flat at near the zero line, giving a neutral signal for the pair.

Resistance level: 0.8863, 0.8920

Support level: 0.8800, 0.8715

US equities experienced a sharp decline, particularly in the automobile sector, as investors reacted to Trump’s widening trade policies. Major automakers such as General Motors (GM), Ford (F), and Stellantis (STLA) fell between 3% and 8% in aftermarket trading. Tesla (TSLA) stabilized after initially dropping over 5%, while foreign automakers like Toyota (TM), Honda (HMC), and Ferrari (RACE) also declined between 1% and 3%. The auto sector’s downturn contributed to a broader sell-off on Wall Street.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 45, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 20445.00, 21045.00

Support level: 19900.00, 19160.00

Crude oil prices continued to rise, driven by bullish US inventory data. The Energy Information Administration (EIA) reported a significant drop in US crude inventories by 3.341 million barrels, far exceeding the expected 1.5-million-barrel increase. The larger-than-expected drawdown intensified supply concerns, while resilient demand further supported prices.

Oil prices are trading higher following the prior rebound from the upward trendline. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 70.30, 71.20

Support level: 69.30, 68.50

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!