PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

The Japanese Yen eased on Wednesday morning after the BoJ Deputy Governor indicated that the Japanese central bank would not raise interest rates if global markets remained unstable. This statement has calmed the market and unwound concerns about Yen carry trades. Meanwhile, the dollar has regained strength, with the dollar index (DXY) climbing above the $103 mark.

Additionally, the New Zealand dollar is in focus as today’s New Zealand job data exceeded market expectations, showing an improved unemployment rate and higher wage growth. This suggests that the Reserve Bank of New Zealand may maintain its current restrictive monetary policy for an extended period.

In the equity markets, global equities are expected to ease from recent selling pressure as financial institutions may start buying the dip, providing support for the markets. Asian markets began the day with positive gains, a sentiment likely to be shared with the U.S. market later in the day.

In the commodity market, gold is under pressure due to the strengthening dollar and the rebound in U.S. Treasury yields. Oil prices remain lacklustre as concerns persist over the pessimistic economic outlook and a surprise buildup in U.S. crude stockpiles, as indicated by last night’s data.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.5%) VS -25 bps (11.5%)

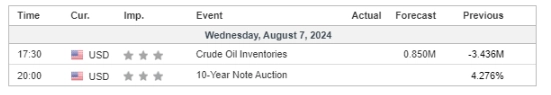

(MT4 System Time)

Source: MQL5

With expectations that the Federal Reserve might cut interest rates aggressively, US Treasury 10-year yields are trending downward. Dovish expectations from the Fed have weighed on the appeal of the US Dollar. While some investors re-entered the dollar market post-stabilization, mostly due to dip buying, the longer-term trend for the dollar remains bearish. Downbeat economic performance and Fed rate cut expectations are likely to continue weighing on the demand for the dollar.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 104.05, 106.05

Support level: 102.40, 100.90

Gold prices extended their losses as investors sold off gold to convert it into cash to cover margin calls from banks. Following the global equity market and crypto asset selloff, investors shifted their portfolios to these asset classes for dip-buying opportunities. The potential for a trend reversal in the gold market remains data-dependent and influenced by monetary policy expectations. Investors should continue monitoring these catalysts for further trading signals.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2415.00, 2450.00

Support level: 2380.00, 2355.00

Pound Sterling eased in strength as the country faced social uncertainty due to ongoing riots. Anti-immigrant riots in multiple cities across the U.K. have dented confidence in Sterling. Meanwhile, the U.S. dollar regained strength, bolstered by an improvement in U.S. Treasury yields exerting downside pressure on the pair.

GBP/USD has recorded four weeks of straight decline and is trading toward its lowest level since June, suggesting a bearish bias for the pair. The RSI remains close to the oversold zone, while the MACD has a bearish cross and is edging lower, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.2780, 1.2850

Support level: 1.2630, 1.2550

The EUR/USD pair faced profit-taking sentiment after surpassing the 1.1000 mark and is struggling to sustain above the next support level near 1.0900. A break below this level would suggest a solid bearish bias for the pair. The euro’s strength was hindered by disappointing eurozone Retail Sales figures released yesterday, while the U.S. dollar index reclaimed its $103 territory last night, exerting further downside pressure on the pair.

The pair continues to trade in a downtrend trajectory since it hit its highest level in 2024. The RSI has dropped out from the overbought zone while the MACD has a bearish cross and is edging lower suggest the bullish momentum is easing.

Resistance level: 1.0940, 1.0985

Support level: 1.0895, 1.0853

The Japanese Yen traded softer after the BoJ released a dovish statement, leading the USD/JPY pair to rebound sharply from its recent bearish trend. The BoJ Deputy Governor claimed that the Japanese central bank would not raise interest rates further if the markets are unstable, which calmed market unease regarding the Yen carry trade.

The pair has rebounded by more than 3% from its recent low level near the 141.80 mark. The RSI has surged sharply from the oversold zone, while the MACD has a bullish cross and is edging toward the zero line from below, suggesting the bearish momentum is easing.

Resistance level: 148.65, 150.10

Support level: 145.27, 143.55

The NZD/USD pair surged sharply during Wednesday’s Sydney session after the release of New Zealand’s job data. The data exceeded market expectations, showing an improved unemployment rate and heightened wage growth. This suggests that the Reserve Bank of New Zealand (RBNZ) may stick with its current monetary tightening policy, bolstering the Kiwi’s strength.

The pair has broken above its resistance level at 0.5960, suggesting a trend reversal signal. The RSI has been flowing above the 50 level, while the MACD was supported above the zero line, suggesting the pair is trading with bullish momentum.

Resistance level: 0.6020, 0.6080

Support level: 0.5910, 0.5860

The global financial market began stabilising after the aggressive selloff on Monday. Hedge funds and institutional investors bought the dip, supporting the equity market. The S&P 500 index rebounded by 1% on Tuesday after experiencing its worst session in almost two years. Wall Street’s chief fear gauge, the CBOE VIX Index, fell from its highest level since 2020 as the market began to digest the previous volatility.

S&P 500 is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 35, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 5400.25, 5670.00

Support level: 5150.00, 4949.70

Crude oil prices retreated despite rising Middle East tensions that continue to spark fears of supply disruption. The primary catalysts for the sharp decline in oil prices are the pessimistic global economic outlooks, particularly in major oil importers China and the US, which have recently reported worse-than-expected economic performances. Investors should continue monitoring global economic performance to gauge future movements in the oil market.

Oil prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 38, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 75.30, 78.55

Support level: 72.45, 70.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!