-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

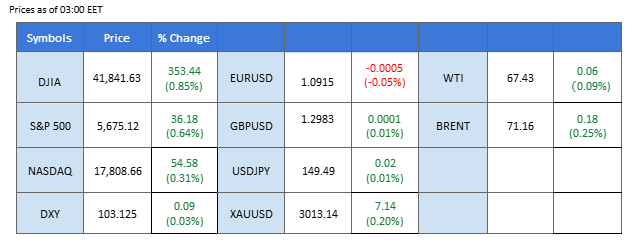

Market Summary

The financial markets are on edge as investors await tomorrow’s highly anticipated FOMC monetary policy decision, a pivotal event that could shape market sentiment in the coming weeks. The prevailing expectation is that the Federal Reserve will adopt a more dovish stance, aiming to shield the U.S. economy from slipping into a recession. This shift in tone would mark a significant departure from the Fed’s previous hawkish posture and could weigh on the dollar while potentially fueling a broader market rally.

Adding to the anticipation, the Bank of Japan is also set to announce its interest rate decision on the same day. The Japanese Yen has remained under pressure in recent sessions, with traders adjusting their expectations for a more accommodative stance from the BoJ. Given the heightened uncertainties in global financial markets, investors believe the Japanese central bank may opt to maintain its ultra-loose policy to stabilize economic conditions.

In equity markets, Wall Street extended its gains, with all three major indices closing higher in the last session. The optimism was fueled by U.S. Retail Sales data, which, while failing to meet market expectations, still came in stronger than the previous reading. This helped ease recession fears and provided a boost to risk appetite. Meanwhile, Chinese proxy currencies, including the Australian dollar and the New Zealand dollar, surged as sentiment improved following robust Chinese economic data. Additionally, reports of an imminent economic stimulus package from Beijing have further bolstered the outlook for both currencies.

In the commodities space, gold has surged past the $3,000 mark, underpinned by escalating geopolitical tensions in the Red Sea, where the U.S. military is engaged in a confrontation with Houthi rebel forces. The heightened uncertainty has also lent support to oil prices, keeping them elevated at recent highs as markets assess potential supply disruptions stemming from the ongoing conflict.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool0 bps (95%) VS -25 bps (5%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The U.S. dollar extended its decline in the last session after the softer-than-expected Retail Sales data heightened concerns over the strength of the U.S. economy. With the FOMC interest rate decision due tomorrow, investors are increasingly betting that the Fed may adopt a more dovish stance to cushion recession risks. Despite the Retail Sales print coming in higher than the previous reading, it fell short of market expectations, reinforcing speculation that the Fed will maintain a cautious tone. As a result, the dollar index (DXY) slipped further.

The Dollar Index is now supporting above its critical level at near 103.35. A break below this level should be seen as a solid bearish signal for the index. The RSI remains below the 50 level while the MACD seemingly fails to break above the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 105.65, 107.60

Support level: 101.70, 100.25

Gold prices surged back to the $3,000 mark, rebounding from an earlier technical retracement driven by profit-taking sentiment. The precious metal remains in a strong uptrend, supported by heightened risk-off sentiment amid escalating geopolitical and trade uncertainties. Investors continue to seek gold as a safe-haven asset, with demand further bolstered by increased geopolitical tensions in the Red Sea. The U.S. government’s military response to Houthi rebel attacks on oil shipments has intensified concerns over potential disruptions in global trade and energy supply.

Gold prices have broken above the sideway range, suggesting a bullish bias for gold. The RSI remains in the overbought zone, while the MACD remains at the elevated level, suggesting that the bullish momentum remains solid.

Resistance level: 3031.00, 3075.00

Support level: 2988.00, 2935.00

The GBP/USD pair edged higher in the last session, reflecting a bullish bias as traders position ahead of two key central bank decisions this week. The Bank of England (BoE) is expected to hold a more hawkish stance in its Thursday monetary policy decision, supporting the Pound’s strength. Meanwhile, the market sentiment has shifted toward a more dovish Federal Reserve, with expectations that the FOMC will be giving a dovish signal amid growing recession risks in the U.S. If the Fed adopts a dovish tone tomorrow, the GBP/USD pair could extend its gains, potentially breaking above the key 1.3000 psychological level.

The GBP/USD has been gradually moving upward, suggesting a bullish bias for the pair. The RSI remains close to the overbought zone, while the MACD shows signs of rebounding from above the zero line, suggesting that the bullish momentum remains solid for the pair.

Resistance level: 1.3050, 1.3155

Support level: 1.2955, 1.2860

The EUR/USD pair is hovering near its previous high at the 1.0930 mark, with a breakout above this level signaling a bullish continuation for the pair. Traders are closely watching tomorrow’s Eurozone CPI release, which is expected to come in slightly lower than the previous reading. However, if the inflation data supports the European Central Bank (ECB) in maintaining a hawkish stance, the euro could stay strong and push higher against the lacklustre U.S. dollar.

The pair has recovered from the previous bearish trend and is now testing its critical resistance level. A break above the current level should be seen as a bullish signal for the pair. The RSI remains close to the overbought zone, while the MACD seemingly found support above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 1.0955, 1.1075

Support level: 1.8060, 1.0672

The USD/JPY pair has broken above the critical resistance at 148.20 and is now firmly in a bullish trend, approaching the key psychological level of 150.00. The Japanese yen has turned bearish as market expectations for the Bank of Japan (BoJ) have shifted from hawkish to dovish, driven by heightened economic uncertainty. This shift has further pressured the yen, allowing the dollar to gain traction.

The pair is about to break above its immediate resistance level at the 149.50 mark, which should be a bullish signal for the pair. The RSI has been gradually moving upward, while the MACD has broken above the zero line and is diverging, suggesting that the bullish momentum is gaining.

Resistance level: 151.30, 154.00

Support level: 147.00, 143.80

The AUD/USD pair surged to its highest level in March, driven by optimism surrounding the latest Chinese economic data. As a currency closely tied to China’s economic performance, the Australian dollar gained momentum after China’s industrial production and retail sales figures came in stronger than expected, reinforcing confidence in the region’s economic resilience. The Aussie also found support as the U.S. dollar remained under pressure ahead of tomorrow’s FOMC monetary policy decision. With markets anticipating a more dovish stance from the Fed, sentiment has shifted in favor of riskier assets, allowing the AUD/USD pair to extend its gains.

The pair gained nearly 1% in the last session and did not retrace, suggesting that the bullish momentum is strong. The RSI has broken into the overbought zone, while the MACD is diverging after breaking above the zero line, in line with the view of strong bullish momentum.

Resistance level: 0.6430, 0.6540

Support level: 0.6365, 0.6300

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!