-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

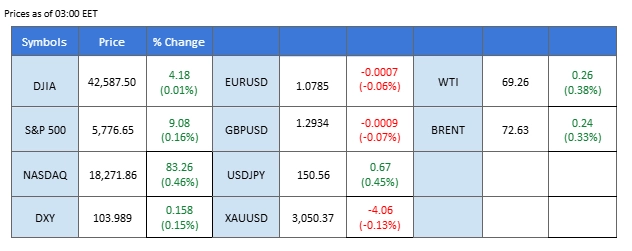

Market Summary

Market sentiment remains clouded by uncertainty over Trump’s tariff policy, set to take effect on April 2. While the U.S. dollar remains subdued, it has gained slightly from its previous sideways range, with long-term Treasury yields recovering from monthly lows—potentially offering support for the greenback.

Meanwhile, Wall Street is extending its rebound, seemingly ending its recent rout, as capital shifts away from the fading Chinese AI rally sparked by DeepSeek’s debut. Traders are also bracing for key U.S. economic data, including tomorrow’s GDP release and Friday’s PCE reading, both of which could shape expectations for Fed policy.

In forex markets, the pound remains muted ahead of the UK CPI release, with traders awaiting a catalyst to drive movement.

In commodities, oil prices remain on the front foot, with WTI approaching the key psychological $70 mark. The latest API weekly crude stockpile data showed an unexpected draw of 14.6 million barrels, suggesting strong U.S. demand and further bolstering crude prices.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86.4%) VS -25 bps (13.6%)

Market Overview

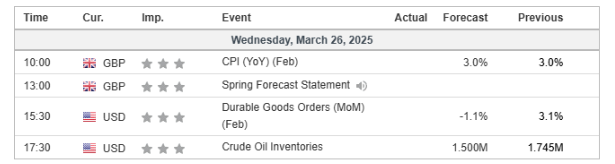

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index eased slightly, pressured by weak US economic data that dampened confidence in the country’s economic outlook. The CB Consumer Confidence Index declined from 100.1 to 92.9, falling below expectations of 94.2, while New Home Sales came in at 676K, missing the forecast of 682K. However, the dollar’s long-term trend remains flat, as investors await further clarity on Trump’s tariff policy implementation.

The Dollar Index is trading flat while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 104.55, 105.90

Support level: 103.25, 101.85

Gold steadied at $3,020, rebounding 0.3% after testing key support at $3,000. The metal remains in consolidation after hitting a record $3,057, as safe-haven demand clashes with a resurgent dollar. Investors await Trump’s April 2 tariff details, which could stoke inflation fears and drive risk aversion. Meanwhile, Friday’s PCE inflation print is critical—an upside surprise may delay Fed rate-cut bets, pressuring gold, while a softer read could reignite bullish momentum.

The price remains in a consolidation phase near 3,020, hovering around the 50% Fibonacci retracement level at 3,026. Momentum indicators show mixed signals as RSI at 50.21 suggests a neutral stance, while MACD remains weak, indicating a lack of strong bullish momentum.

Resistance level: 3025, 3070

Support level: 3005, 2985

The GBP/USD pair appears to have found support after a technical retracement from its recent four-month high above the 1.3000 mark. While the Pound Sterling remains relatively steady, traders are closely watching today’s UK CPI release for clues on the BoE’s monetary policy outlook and its implications for the currency. A stronger-than-expected CPI reading could reinforce expectations of a more hawkish BoE stance, potentially driving the pair higher and allowing it to reclaim its recent highs.

After breaking below its uptrend support level, the GBP/USD faces minor technical retracement and is supported at above 1.2900, which provides a neutral signal for the pair. The RSI remains close to the 50 level, while the MACD flows flat close to the zero line, which also provides a neutral signal for the pair.

Resistance level: 1.3000, 1.3105

Support level: 1.2875, 1.2785

The EUR/USD pair remains anchored near its key support level at 1.0806, maintaining a bearish bias. The euro continues to weaken as optimism surrounding Germany’s mega-budget plan fades, while the recent eurozone PMI readings failed to provide any bullish catalyst. Meanwhile, rising U.S. Treasury yields have bolstered the dollar, adding to the downside pressure on the pair. A sustained break below 1.0806 could reinforce the bearish momentum.

The EUR/USD pair remains trading at its two-week low level, suggesting a bearish bias. The RSI remains close to the oversold zone, while the MACD continues to slide below the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.0955, 1.1075

Support level: 1.0672, 1.0527

The EUR/GBP pair remains confined within its downtrend channel, reinforcing a bearish outlook for the pair. The euro continues to struggle amid recent weak economic data, with the CPI reading falling short of expectations and PMI figures signaling slowing economic growth in the eurozone. Conversely, the Pound Sterling found support from slightly stronger PMI readings and a hawkish tone from the BoE, which has kept the euro under pressure. If the bearish momentum persists, the pair may further decline, with the next key support level in focus.

The EUR/GBP pair continues to slide and reach a new low, suggesting a bearish bias. The RSI has gotten into the oversold zone, while the MACD continues to decline, suggesting that the bearish momentum is gaining with the pair.

Resistance level: 0.8370, 0.8405

Support level: 0.8305, 0.8265

AUD/USD fell 0.14% to 0.6293 amid weak Australian inflation, rising RBA rate-cut bets, and global trade risks. February CPI missed expectations, boosting odds of a May cut to 70%. The RBA remains cautious, while fiscal stimulus complicates policy moves. The USD faces volatility, with DXY down 4% this quarter on weak confidence and tariff threats, though month-end flows may offer support. Upcoming U.S. tariffs on autos and semiconductors could increase risk aversion, pushing AUD/USD toward 0.6200.

AUD/USD remains range-bound, testing resistance at 0.63516 while holding above 0.62880 support. RSI at 52.38 signals mild bullish momentum, and a positive MACD histogram hints at a potential shift. A breakout above 0.63516 could target 0.63727, while failure may trigger a pullback toward 0.62880, with deeper losses if bearish pressure grows.

Resistance level: 0.6350, 0.6375

Support level: 0.6290, 0.6275

Crude oil prices rose, supported by tight supply concerns after Trump’s tariff threats on Venezuelan oil buyers and a larger-than-expected drop in US crude inventories. According to the American Petroleum Institute (API), crude stockpiles fell by 4.6 million barrels, surpassing expectations of a 2.5 million-barrel decline.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 51, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 69.30, 70.30

Support level: 68.50, 67.75

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!