PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

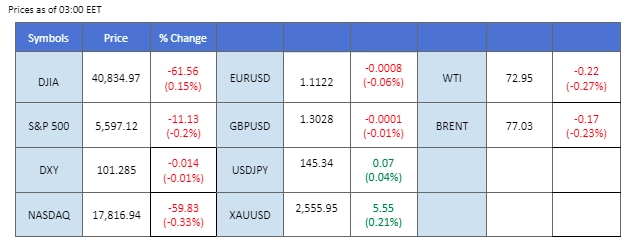

Market Summary

Wall Street took a pause in the last session, with all three major indexes remaining relatively flat as investors awaited the highly anticipated FOMC meeting minutes. Should the minutes align with market expectations and present a dovish tone, it could put further downward pressure on the dollar while potentially fueling gains in the equity market.

The weakening dollar has pushed the euro and the British pound to their highest levels in 2024, with traders closely watching the Jackson Hole Economic Symposium, which starts on Thursday. This event is expected to provide critical insights into the future monetary policy moves of key central banks.

In the commodity market, gold reached another all-time high at $2,531.70, supported by the weakening dollar and the prospect of a Fed rate cut in September. On the other hand, oil prices continue to struggle, weighed down by easing tensions in the Middle East and disappointing economic data from China. These bearish factors have kept oil under pressure, contributing to its lacklustre performance.

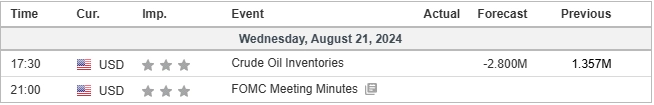

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index (DXY) is currently under strong bearish pressure, having fallen below the critical price consolidation range at $102.30. The decline is largely driven by increased speculation of a potential Fed rate cut in September. Market participants are now eagerly awaiting the FOMC meeting minutes due later today, which could provide more clarity on the Fed’s stance. If the minutes reveal a dovish tone, it is likely to further weigh on the dollar, exacerbating its recent downward trajectory.

The Dollar Index has dropped about 1% this week, suggesting a bearish bias. As the index is approaching a critical support level at 101.30, a drop below such a level will be a solid bearish signal. The RSI has dropped into the oversold zone, while the MACD is edging lower and diverging, suggesting the bearish momentum remains strong.

Resistance level: 102.35, 103.35

Support level: 101.10, 99.95

Gold prices have continued to extend their gains, reaching a new all-time high of $2,531.70. This surge is largely attributed to the weakened dollar and growing expectations of a potential shift in the Fed’s monetary policy in the near term. As gold remains in a strong bullish trajectory, the upcoming FOMC meeting minutes and Jerome Powell’s speech at the Jackson Hole Economic Symposium are key events that could significantly influence the metal’s price movement. A dovish tone from these events could further bolster gold, while any hints of hawkishness might temper the current rally.

Gold prices have once again recorded an all-time high, suggesting an extremely bullish signal for gold. The RSI remains close to the overbought zone, while the MACD continues to edge higher, suggesting that gold remains trading with bullish momentum.

Resistance level: 2535.00, 2585.00

Support level: 2495.00, 2465.00

The British pound continues to gain strength against the U.S. dollar, buoyed by ongoing speculation of a potential Fed rate cut. The GBP/USD pair has reached its highest level in 2024, indicating a strong bullish bias. The upcoming release of the FOMC meeting minutes will be crucial for the pair’s direction. If the minutes reveal a dovish tone, it could further fuel the upward momentum for the pound, pushing the pair even higher.

GBP/USD is currently trading with extremely strong bullish momentum and has risen more than 1.4% this month. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Resistance level: 1.3065, 1.3140

Support level: 1.2985, 1.2915

The EUR/USD pair has surged to its highest level in 2024 and is nearing its highest point in a year. The recent eurozone CPI reading aligned with market expectations, indicating rising inflationary pressure in the region. With the ECB expected to maintain its current interest rate levels, euro traders will be closely watching the Jackson Hole Economic Symposium on Thursday. Any comments from the ECB chief regarding the inflationary situation could significantly influence the euro’s trajectory.

EUR/USD is currently trading in extreme bullish momentum after the pair broke above its psychological resistance level at 1.1000 and was given a bullish signal. The RSI has broken into the overbought zone, while the MACD continues to edge higher, suggesting the bullish momentum remains strong.

Resistance level: 1.1180, 1.1230

Support level: 1.1040, 1.0985

The NZD/USD pair has climbed to its highest level since July, benefiting from the softened U.S. dollar. Despite the RBNZ’s surprise 25 bps rate cut last week, the impact on the pair was minimal. Kiwi traders are now focused on tomorrow’s New Zealand Retail Sales reading, which could serve as a catalyst for the pair to continue its upward momentum.

The NZD/USD pair has gained nearly 2% this week, suggesting a bullish bias. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the pair’s bullish momentum remains strong.

Resistance level: 0.6210, 0.6260

Support level: 0.6080, 0.6020

The Japanese Yen is capitalising on the softened U.S. dollar, trading below its critical liquidity zone near the 147.00 mark, indicating a bearish bias for the USD/JPY pair. Last week’s upbeat Japan GDP reading has provided additional support for the Yen. Moreover, the prospect of a narrowing interest rate gap between the Bank of Japan and the Federal Reserve is likely to further pressure the pair, adding to the downside momentum. Yen traders may be eyeing Japan’s National CPI reading on Friday to gauge the strength of the yen.

The USD/JPY pair has traded below the liquidity zone at near 147.00, suggesting a bearish bias for the pair. The RSI is nearing the oversold zone, while the MACD has broken below the zero line and is edging lower, suggesting bearish momentum is forming.

Resistance level: 149.20, 151.75

Support level: 143.45, 141.40

Crude oil prices have been under significant pressure, dropping more than 3% this week, reflecting a clear bearish bias. The easing of tensions in the Middle East and disappointing Chinese economic data have been the primary drivers of this decline. However, oil traders are closely watching today’s U.S. weekly crude inventory data and the FOMC meeting minutes. These events could potentially catalyse a rebound in oil prices, especially if the data or commentary suggests stronger demand or a shift in economic sentiment.

Oil prices are trading lower but are approaching their critical support level at near 72.40, which may be buoyed by strong buying pressure. They remain close to the oversold zone, while the MACD may have a bullish cross below the zero line, suggesting the bearish momentum may be easing.

Resistance level: 75.20, 78.55

Support level: 72.40, 70.40

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!