-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

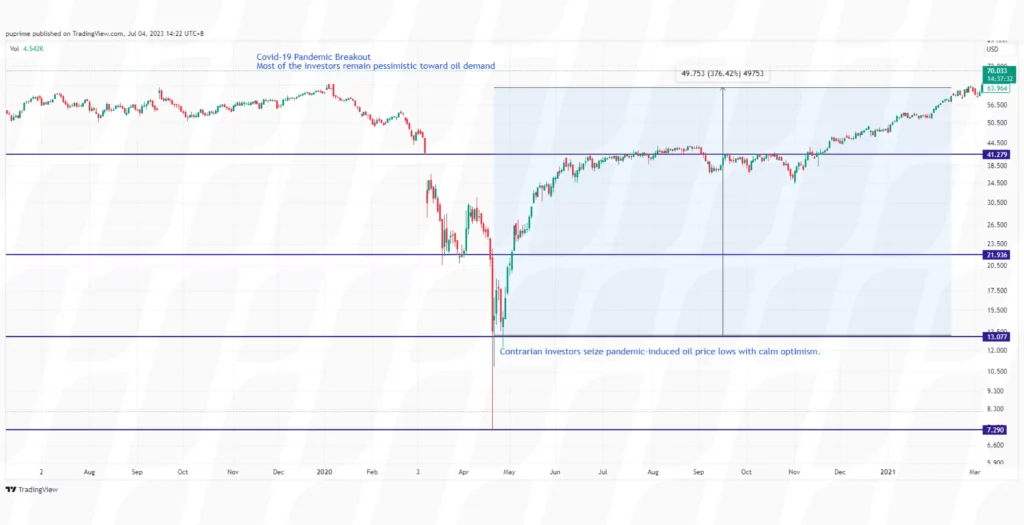

In the dynamic world of financial markets, a contrarian trading strategy could provide an intriguing approach for traders and investors. Contrarian traders challenge the prevailing market sentiment and seek trading opportunities when others are pessimistic or overly optimistic. By going against the crowd, these savvy investors aim to profit from market reversals. In this article, we will delve into the foundations of the contrarian trading strategy, explore popular trading strategies, and provide insights on how to effectively implement them.

Contrarian trading strategies are based on the belief that markets are prone to overreaction, leading to temporary imbalances in prices. Understanding what contrarian trading is boils down to understanding market sentiment, which refers to the collective psychology of investors. Contrarian traders capitalise on the behavioural biases of market participants, such as fear and greed, by taking positions contrary to prevailing sentiment.

There are many different ways contrarian traders implement a contrarian trading strategy. In this article, we will delve into what the different contrarian trading strategies are and how contrarian traders utilise them.

The reversal trading strategy is a popular contrarian trading strategy used by contrarian traders. It involves identifying points of market exhaustion or extreme sentiment and taking positions in anticipation of a reversal in market direction. By betting on a reversal, contrarian traders aim to profit as the market sentiment shifts. Here’s how contrarian traders utilise the reversal trading strategy:

Identifying Overbought/Oversold Conditions: Contrarian traders often utilise technical indicators to identify overbought or oversold conditions in the market. Overbought conditions occur when prices have risen too quickly and are considered overvalued, while oversold conditions occur when prices have declined excessively and are deemed undervalued. Technical indicators such as the Relative Strength Index (RSI) can help identify these extreme conditions.

Spotting Reversal Patterns: Contrarian traders keep a close eye on chart patterns and price action to spot potential reversal signals. Common reversal patterns include double tops and bottoms, head and shoulders patterns, and bullish or bearish divergences between price and indicators. These chart patterns indicate a potential shift in market sentiment and provide entry points for contrarian traders to take positions opposite to the prevailing trend.

Analysing Fundamental Analysis Factors: In addition to technical analysis, contrarian traders may also consider fundamental analysis factors that suggest an impending market reversal. This could include analysing economic data, company earnings reports, or news events that may influence market sentiment. By identifying instances where market sentiment has diverged significantly from underlying fundamentals, contrarian traders may anticipate a reversal in prices.

Timing Entry and Exit Points: Timing is crucial in the reversal trading strategy. Contrarian traders exercise caution to enter positions neither too early nor too late. They look for confirmatory signals that validate the potential reversal before taking action. This could involve waiting for a specific price level to be breached, a particular candlestick pattern to form, or a combination of technical indicators to align. They also use stop-loss orders to protect against adverse price movements and exit positions when the reversal appears to have run its course.

Monitoring Market Sentiment: Contrarian traders constantly monitor market sentiment indicators to gauge the overall mood of market participants. When sentiment reaches extreme levels of optimism or pessimism, it can indicate an impending reversal. By taking positions opposite to the prevailing sentiment, contrarian traders aim to profit as market sentiment shifts and price reversal occurs.

However, it is also important to note that a contrarian trading strategy using the reversal trading strategy carries risks, as market reversals may not always occur as expected. Effective risk management in trading strategies, thorough analysis, and a combination of technical and fundamental analysis factors are crucial for successful implementation of this strategy.

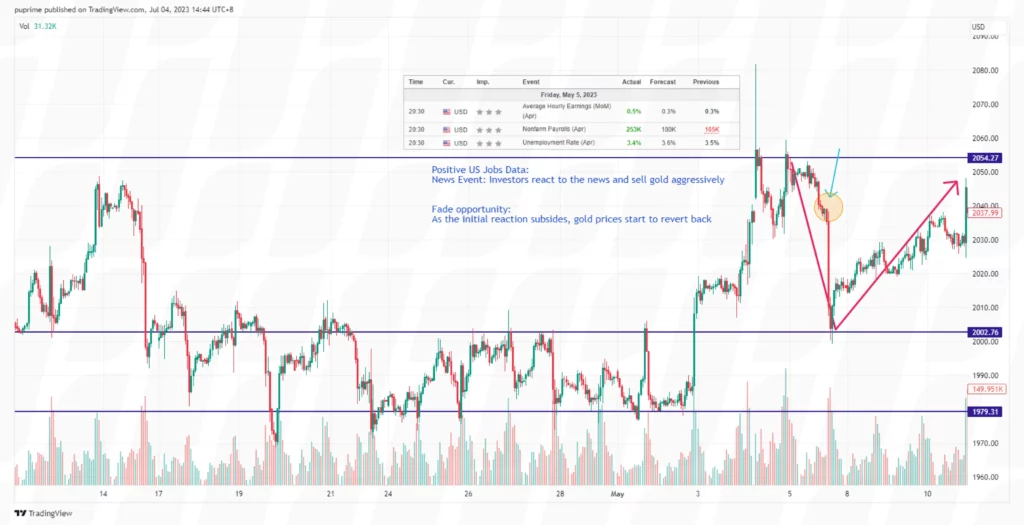

The news fade strategy is a contrarian trading strategy that involves taking positions opposite to the initial market reaction following significant news events. Contrarian traders using the news fade strategy aim to capitalise on the tendency of market participants to overreact to financial news, leading to exaggerated price movements. Here’s how contrarian traders utilise the news fade strategy in contrarian trading:

Identifying Significant News Events: Contrarian traders actively monitor news events that have the potential to impact the market by catching up with daily financial news. These events could include economic data releases, earnings reports, geopolitical developments, or any other news that is expected to have a significant influence on market sentiment. The goal is to identify news events that have the potential to generate a strong initial market reaction.

Assessing Market Overreaction: After a significant news event, contrarian traders analyse the initial market reaction. This involves evaluating whether the price movement following the news is disproportionate to the actual impact of the news on the underlying asset or market. The objective is to identify instances where market participants have overreacted due to fear, greed, or other behavioural biases.

Waiting for Market Correction: Contrarian traders exercise patience and wait for the initial market overreaction to correct itself. They understand that initial knee-jerk reactions to financial news may not always be sustainable and that prices can quickly reverse. By waiting for the market to stabilise and the initial euphoria or panic to subside, contrarian traders aim to identify potential entry points.

Entry and Exit Timing: Once the initial market overreaction has subsided, contrarian traders look for entry points to take positions opposite to the prevailing sentiment. This could involve entering long positions when the market has initially sold off excessively or entering short positions when the market has experienced an unwarranted rally. Technical analysis tools, such as support and resistance levels or chart patterns, may be employed to help identify optimal entry and exit points.

Risk Management In Trading: Effective risk management is crucial in the news fade strategy. Contrarian traders set stop-loss orders to protect against adverse price movements in case the initial market reaction proves to be justified or continues further. They also employ proper position sizing techniques to manage risk exposure.

It’s important to note that the news fade strategy requires careful analysis and an understanding of market dynamics. Contrarian traders must be able to distinguish between genuine overreactions and situations where the initial market reaction is justified by the news. Thorough research, awareness of market sentiment, and disciplined execution are key to successfully implementing the news fade strategy as a contrarian trading strategy.

Last but not the least, the sentiment analysis strategy is a contrarian trading strategy that involves gauging the overall mood or sentiment of market participants to identify potential reversals in market direction. Contrarian traders using sentiment analysis look for extreme readings in sentiment indicators to anticipate shifts in market sentiment. Here’s how contrarian traders utilise the sentiment analysis strategy:

Gathering Market Sentiment Data: Contrarian traders collect data on market sentiment from various sources. This can include surveys, sentiment indicators, social media sentiment analysis, options market data, or even news sentiment analysis tools. The objective is to capture the collective sentiment of market participants, whether it’s bullish (positive sentiment) or bearish (negative sentiment).

Identifying Extreme Sentiment Readings: Contrarian traders focus on identifying instances where market sentiment reaches extreme levels. These extreme readings could indicate that market participants have become overly optimistic or pessimistic, potentially leading to an impending market reversal. Contrarian traders typically look for sentiment readings that deviate significantly from historical averages or consensus expectations.

Contrarian Positioning: Based on the extreme sentiment readings, contrarian traders take positions that are opposite to the prevailing sentiment. If sentiment is excessively bullish, contrarian traders may consider taking short positions, anticipating a potential market downturn. Conversely, if sentiment is overly bearish, contrarian traders may look for long positions, expecting a potential market upswing.

Confirmation and Timing: Contrarian traders exercise caution and look for confirmatory signals before entering trades based on sentiment analysis. Similar to the previous contrarian trading strategies, they may also employ additional technical analysis tools or chart patterns to validate the anticipated reversal. Timing is crucial, and contrarian traders aim to enter positions when the sentiment has reached its extreme point but is showing signs of exhaustion or reversal.

Risk Management In Trading: Effective risk management is essential and similarly as well, contrarian traders implement stop-loss orders to limit potential losses if the market continues in the prevailing sentiment direction. They also manage their position sizes and diversify their asset portfolios to mitigate risks associated with a contrarian trading strategy.

Successful implementation of a contrarian trading strategy requires careful consideration and discipline. Here are some key factors to keep in mind:

Risk management is a crucial aspect when implementing a contrarian trading strategy. While contrarian trading can be rewarding, it also carries inherent trading risks due to the potential for market reversals and extended periods of trend continuation. Here are key considerations for contrarian traders to take note when it comes to risk management in trading using a contrarian trading strategy:

Setting Risk Parameters: Before engaging in a contrarian trading strategy, establish risk parameters that align with your risk tolerance and trading objectives. Determine the maximum amount of capital you are willing to risk on each trade or position. This can be expressed as a percentage of your overall portfolio or as a fixed monetary amount.

Proper Position Sizing: Proper position sizing is essential for effective risk management. Calculate the appropriate position size based on your risk parameters, the stop-loss level, and the potential reward-to-risk ratio of the trade, and adjust your position size to ensure that a single trade does not expose you to excessive risk. These would help to protect your capital in case the trade goes against you.

Implementing Stop-Loss Orders: Implementing stop-loss orders is a fundamental risk management technique when it comes to executing a contrarian trading strategy. Determine an appropriate stop-loss level for each trade, based on your analysis and the price level at which the market would confirm that your contrarian trade thesis is invalid. Placing a stop-loss order helps limit potential losses by automatically closing the trade if the price reaches the predetermined level.

Evaluating The Risk-Reward Ratio Often: Evaluate the risk-reward ratio of each trade before entering a position. A favourable risk-reward ratio means that the potential reward outweighs the potential risk. Aim for trades with a higher potential reward relative to the risk taken. This helps ensure that the potential gains from successful contrarian trades outweigh the potential losses from unsuccessful ones.

Continuous Monitoring Of Trade Positions: Keep a close eye on your positions and the market dynamics. Monitor the progress of your contrarian trades and be prepared to adjust or exit positions if the market proves persistent in its prevailing sentiment. Continuously re-evaluate your trades based on new information, technical indicators, or changes in market conditions.

Practising Emotional Discipline: Similar to the previous two contrarian trading approaches, maintaining emotional discipline when implementing contrarian trading strategies is essential. Emotions such as fear or greed can lead to irrational decision-making. Stick to your predefined risk parameters, follow your trading plan, and avoid making impulsive trades based on short-term market fluctuations.

Remember that risk is inherent in trading, and even with risk management measures in place, losses are possible. It’s important to thoroughly understand the risks associated with a contrarian trading strategy and consider seeking professional advice or guidance when needed.

Contrarian trading often requires patience, as markets may take time to reverse. Timing is crucial, and traders must exercise caution not to enter positions too early or too late. Waiting for confirmatory signals and using technical analysis can assist in identifying optimal entry and exit points.

A comprehensive understanding of both fundamental and technical analysis is beneficial for contrarian traders. Fundamental analysis helps identify undervalued or overhyped assets, while technical analysis provides insights into potential reversal patterns and market exhaustion. By combining insights from both disciplines, traders can gain a more comprehensive understanding of market dynamics and make informed contrarian trading decisions. Here are some considerations for effective integration of fundamental and technical analysis in a contrarian trading strategy:

Confirming Contrarian Signals: Use technical analysis to confirm contrarian signals derived from fundamental analysis. Seek alignment between the fundamental view (overvalued/undervalued) and technical indicators suggesting a reversal.

Weighing the Relative Importance: Assess the relative importance of fundamental and technical factors based on the specific trade setup and market conditions. Certain trades may be more reliant on fundamental analysis, while others may lean more towards technical analysis.

Ongoing Monitoring and Adjustments: Continuously monitor both fundamental and technical factors as the trade progresses. Stay alert to new information, changes in market conditions, or shifts in market sentiment that may require adjustments to the trading strategy.

Remember that the integration of fundamental and technical analysis in the implementation of a contrarian trading strategy is a dynamic process, and there is no one-size-fits-all approach. It requires experience, practice, and ongoing learning to refine your ability to integrate and leverage insights from both disciplines effectively.

While contrarian trading strategies provide distinct advantages, such as profit potential and timing opportunities, they also come with certain limitations. Understanding these advantages and limitations is crucial for contrarian traders seeking to implement contrarian trading strategies effectively. By gaining insights into the advantages and limitations, these traders can make informed decisions and develop effective risk management in trading using contrarian trading.

Profit Potential: Contrarian trading strategies aim to identify market reversals, offering the potential for significant profits. By entering positions against prevailing sentiment, traders can capitalise on mispricings and take advantage of market inefficiencies.

Timing Opportunities: Contrarian trading strategies focus on identifying turning points in the market. By taking positions when sentiment reaches extremes, traders have the potential to enter trades at optimal entry points, increasing the likelihood of capturing a trend reversal.

Diversification Benefits: Contrarian trading can provide diversification benefits to a portfolio. By going against the prevailing sentiment, contrarian trades may exhibit low correlation with other market participants, helping to reduce overall portfolio risk.

Psychological Advantage: Contrarian trading requires a contrarian mindset, which can provide a psychological advantage. Contrarian traders are more likely to avoid herd behaviour, emotional biases, and market euphoria or panic, enabling them to make rational trading decisions.

Timing Challenges: Timing the market accurately is one of the biggest challenges in contrarian trading. Identifying the exact turning points and the duration of market reversals can be difficult, as sentiment can persist longer than expected before reversing.

False Reversals: Contrarian trading strategies are prone to false signals, where the anticipated reversal fails to materialise. Traders must be cautious about distinguishing genuine reversals from temporary fluctuations or noise in the market.

Increased Risk: Contrarian trading strategies involve taking positions against prevailing sentiment, which inherently carries increased risk. If the market continues in the prevailing sentiment direction, contrarian traders may experience losses. Effective risk management and stop-loss orders are crucial in mitigating this risk.

Information Lag: Contrarian traders rely on identifying discrepancies between sentiment and underlying fundamentals. However, there can be a delay in gathering and analysing the necessary information, leading to missed opportunities or entering trades after the initial price movement has already occurred.

It’s important to note that successful implementation of contrarian trading strategies requires skill, experience, and thorough analysis. Traders should carefully assess the advantages and limitations while considering their risk tolerance, time horizon, and overall trading approach.

A contrarian trading strategy offers a compelling alternative to conventional investment approaches. By capitalising on market sentiment shifts and going against the crowd, contrarian traders can potentially profit from temporary market imbalances. Successful implementation requires careful risk management, timing, and a solid understanding of market dynamics. As with any trading strategy, thorough research and continuous learning are essential for mastering the art of contrarian trading.

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!