-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

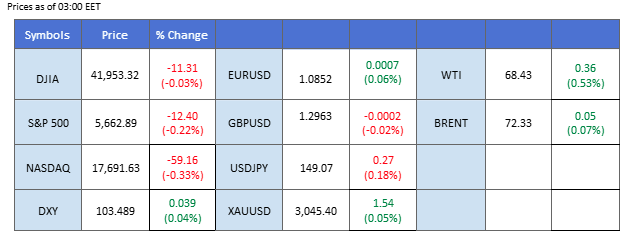

Market Summary

Donald Trump has once again put his aggressive tariff policy at the center of financial market attention, announcing that the proposed reciprocal tariffs and additional sector-specific levies on all U.S. trade partners will take effect on April 2. The move has unsettled markets, fueling fears of a global trade war.

Wall Street lost momentum, reversing its previous rally that was driven by the Fed’s dovish stance, while the U.S. dollar remained under pressure. The heightened uncertainty in global markets has sparked demand for safe-haven assets, with gold continuing to trade at record highs. The Japanese yen also regained strength as Japan’s inflation rate hit 3%, reinforcing expectations that the Bank of Japan could move toward a more hawkish policy stance.

In the U.K., the Bank of England held interest rates steady as expected but signaled a cautious approach to future policy, citing risks from Trump’s trade strategy. This helped buoy the Pound Sterling. Meanwhile, the euro faced headwinds after the eurozone delayed implementing retaliatory tariffs on U.S. alcoholic beverages, a move that weighed on the single currency in the last session.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool0 bps (83.3%) VS -25 bps (16.7%)

Market Overview

Economic Calendar

(MT4 System Time)

N/A

Source: MQL5

Market Movements

The Dollar Index rebounded slightly, supported by stronger-than-expected US economic data. The Initial Jobless Claims report showed 223K new claims, slightly better than the 224K forecast. Additionally, the Philadelphia Fed Manufacturing Index (12.5 vs. 8.8 expected) and Existing Home Sales (4.26M vs. 3.95M expected) exceeded market expectations, further bolstering the dollar’s strength. However, the long-term outlook remains bearish, as the FOMC reaffirmed plans for rate cuts in 2025. Fed Chair Jerome Powell reiterated concerns over recession risks and trade war uncertainties, which could dampen optimism toward the US economy.

The Dollar Index is trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 104.05, 104.85

Support level: 103.30, 102.80

Gold prices remained in consolidation, as mixed market sentiment led investors to adopt a wait-and-see approach. Safe-haven demand for gold was supported by rising trade tensions and recession fears, but stronger US economic data tempered bullish momentum, limiting further upside.

Gold prices are trading flat while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 60, experiencing technical correction since the RSI retreated from overbought territory.

Resistance level: 3080.00, 3145.00

Support level: 3035.00, 2990.00

The GBP/USD pair remains under pressure as global economic uncertainties persist. The Bank of England (BOE) has maintained a cautious stance, keeping rates steady at 4.5%, with markets pricing in over a 50% chance of a rate cut in May. However, the country’s wage growth at 5.8% continues to outpace inflation, adding to inflationary pressures may delay BoE’s monetary easing plan and support the Cable. Meanwhile, the Federal Reserve’s firm stance on inflation, with rate cuts likely to be delayed, is strengthening the USD, creating additional downside pressure on GBP/USD.

GBP/USD has pulled back after failing to break above the 1.2995 resistance level, consolidating around 1.2960. A sustained break below these levels could reinforce bearish momentum toward 1.2783. The RSI is sliding while the MACD remains below the signal line, hinting at bearish momentum.

Resistance level: 1.2995, 1.3050

Support level: 1.2934, 1.2853

The EUR/USD pair extended its decline in the last session, sliding to its lowest level of the week near the 1.0855 mark. The euro came under pressure as the European economic bloc opted to delay its retaliatory tariffs on U.S. goods and instead sought negotiations with the Trump administration. Meanwhile, President Trump reaffirmed that the proposed reciprocal tariffs on broad U.S. trade partners would take effect on April 2, further unsettling market sentiment. The policy uncertainty weighed on the euro, allowing the dollar to gain ground despite its overall fragile performance in recent sessions.

The pair is edging lower and is testing its support level at the near 1.0810 mark. A break below this level should be a bearish signal for the pair. The RSI has slid below the 50 level, while the MACD is about to break below the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 1.0955, 1.1075

Support level: 1.0806, 1.0672

The USD/JPY pair has a structural break after the pair reached new low, suggesting a bearish bias for the pair. Japanese Yen strengthened following February’s core CPI rose 3.0% year-on-year, exceeding forecasts and reinforcing speculation of further monetary tightening. Core-core CPI, which strips out fresh food and energy, climbed 2.6%, highlighting persistent price pressures driven by rising energy costs and strong wage growth. With policymakers signaling concerns over inflation, markets are expecting a potential BOJ rate hike, with rates possibly reaching 1% by the end of 2025.

USD/JPY is holding above key support at 149.14, indicating a potential bullish bias. The RSI is rebounding from lower levels, suggesting strengthening momentum, while the MACD is edging higher from the zero line, signaling a possible shift toward bullish momentum. A break above 149.37 could confirm further upside, while a drop below 146.89 may invalidate the bullish outlook.

Resistance level: 149.37, 151.34

Support level:149.14, 148.34

The USD/CHF pair has broken above its downtrend resistance level, signaling a potential bullish trend reversal. The pair gained traction as the Swiss franc weakened following the Swiss National Bank’s decision to cut interest rates by 25 basis points to 0.25% in the last session. While the move was widely expected, the SNB justified its decision by citing subdued inflationary pressures, even amid heightened uncertainty surrounding Trump’s trade policies. The rate cut weighed on the Swiss franc, prompting a shift in market flows that indirectly supported the U.S. dollar against its counterparts.

The USDCAD formed a double bottom at near 0.8765 and later broke above the downtrend resistance level, suggesting a bullish trend reversal for the pair. The RSI has jumped to above 50, while the MACD has formed a higher-high pattern, suggesting bullish momentum may be forming.

Resistance level: 0.8910, 0.9005

Support level: 0.8700, 0.8605

Crude oil prices edged higher following US sanctions on a Chinese refinery, marking an escalation in efforts to curb Iranian oil exports. The US targeted Shandong Shouguang Luqing Petrochemical Co. and its CEO for allegedly purchasing Iranian oil, sparking fears of supply disruptions and boosting oil prices.

Crude oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the commodity might enter overbought territory.

Resistance level:68.50, 69.30

Support level: 67.75, 66.80

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!