-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

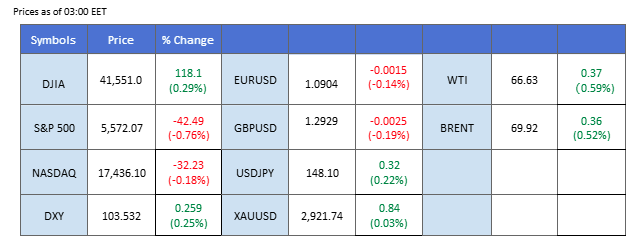

Market Summary

The euro rallied to a four-month high against its peers as geopolitical developments in Eastern Europe drove market sentiment. Reports suggest Ukraine is prepared to accept a month-long ceasefire, while the U.S. plans to restore military aid and intelligence sharing following Kyiv’s acceptance of Washington’s proposal. The news boosted the euro as traders positioned for potential economic stabilization in the region.

Meanwhile, the Japanese yen extended gains, underpinned by decade-high long-term bond yields and expectations that Japanese firms will implement a third consecutive year of strong wage hikes. The prospect of rising inflation has fueled speculation that the Bank of Japan could continue its policy tightening, further supporting the yen.

In the forex market, attention turns to today’s U.S. CPI report, which could be a decisive factor for the recently subdued dollar.

In the commodities market, both gold and oil prices traded within a narrow range, while copper exhibited increased volatility in response to Trump’s aggressive tariff policy on metals. The White House has confirmed a 25% tariff on steel and aluminum imports, with threats to raise tariffs to 50% on the largest U.S. trade partners, adding uncertainty to the global trade outlook.

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

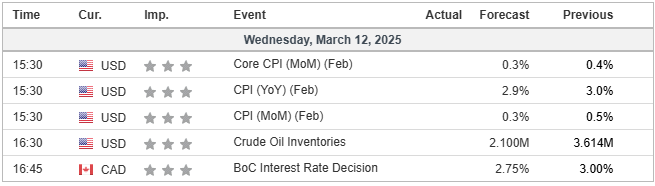

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index (DXY) extended its losses, breaking its market structure as escalating trade uncertainties and the potential for a U.S.-led trade war continued to dampen market optimism regarding U.S. economic growth. Recently, President Donald Trump announced an increase in tariffs on Canadian steel and aluminum, doubling the previous 25% rate to 50%. This decision came in response to Canada’s earlier move to impose a 25% surcharge on electricity exports to Minnesota, New York, and Michigan—though Canada later agreed to suspend the hike, tensions remain elevated. As recession fears persist, selling pressure on the U.S. dollar intensified on Tuesday.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 105.45, 106.50

Support level: 103.40, 101.90

As the U.S. dollar continues to weaken and equity markets extend their losses, investors are increasingly seeking refuge in safe-haven assets. Global trade tensions and rising recession risks have diminished risk appetite, driving a shift in sentiment toward gold. The escalating trade dispute between the U.S. and Canada, coupled with broader economic uncertainty, has further reinforced gold’s appeal as a hedge against market volatility. Moving forward, investors will closely monitor trade negotiations and tariff developments to gauge potential market movements and the continued demand for safe-haven assets.

Gold prices gained in the last session but remain below the resistance level that has kept them from surging for the entire month of March; a break above such a level should be a solid bullish signal for gold. Both the RSI and MACD saw a higher-high pattern, suggesting that the bearish momentum is vanishing.

Resistance level: 2955.00, 3005.00

Support level: 2875.00, 2834.45

The GBP/CAD pair surged to its highest level since 2016 after successfully breaking past the 1.8120 resistance level last week. The Pound Sterling continues to show resilience, while the Canadian dollar remains under pressure, weighed down by persistent trade tensions. Fresh threats from the Trump administration to impose a 50% tariff on Canadian imports have exacerbated concerns over Canada’s economic outlook, further weakening the loonie. The pair remains in a strong uptrend, with market focus now shifting to upcoming economic data that could influence further price action.

The pair has been trading in an uptrend, and it has a more solid bullish signal after breaking its month-long resistance level at 1.8120. The RSI has gotten into the overbought zone, while the MACD has been diverging after breaking above the zero line, suggesting that the pair remains trading with sufficient bullish momentum.

Resistance level: 1.8970, 1.9400

Support level: 1.8600, 1.8110

The USD/JPY pair remains in a downtrend but saw a technical rebound in the last session. A break above the 148.20 resistance level could signal a potential shift toward a bullish bias. However, the Bank of Japan (BoJ) Governor’s latest remarks indicate that the central bank anticipates rising bond yields, fueled by expectations of future interest rate hikes. This reinforces speculation that the BoJ may tighten policy next week, which could further strengthen the Japanese yen, capping upside potential for USD/JPY. Traders will closely watch upcoming BoJ guidance for confirmation of policy direction.

The pair has been trading in a long-term downtrend but has seen a minor rebound lately. A break above the previous high level should be a bullish trend reversal signal for the pair. The RSI is rebounding, while the MACD is heading toward the zero line from below, suggesting that the bearish momentum is easing.

Resistance level: 149.48, 151.35

Support level: 143.80, 140.45

The euro has been gaining momentum, pushing EUR/AUD to its highest level since May 2020 as the Australian dollar weakens. The euro’s strength was further reinforced in the last session as markets responded positively to reports that Ukraine has accepted a U.S.-proposed ceasefire deal, signaling potential de-escalation in the conflict with Russia. Meanwhile, the Aussie dollar continues to face pressure, weighed down by global risk sentiment and uncertainty over China’s economic outlook.

The pair continued to trade to new highs in nearly 5-years, suggesting a bullish bias for the pair. The RSI remains hovering closely to the overbought zone while the MACD continues to edge higher, suggesting that the pair remain trading bullish.

Resistance level:1.7670, 1.8060

Support level: 1.7000, 1.6760

The Canadian dollar (CAD) weakened following the U.S. tariff announcement, as markets priced in a potential tit-for-tat trade war between the two countries. Investors remain cautious, anticipating that Canada could retaliate with non-tariff measures, such as restricting oil exports to the U.S. or imposing additional export duties on key products. Given that Canada is the top supplier of imported oil to the U.S., providing around 4 million barrels per day—primarily to Midwest refineries engineered for Canadian crude—such measures could have significant implications.

USD/CAD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the pair might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 1.4450, 1.4595

Support level: 1.4280, 1.4140

U.S. equities remain under selling pressure as escalating trade policy uncertainty weighs on investor sentiment. President Donald Trump’s proposal to double tariffs on Canadian steel and aluminum to 50% has intensified risk-off sentiment, bringing markets closer to correction territory. The dispute escalated after Ontario Premier Doug Ford imposed a 25% surcharge on electricity exports to the U.S., prompting retaliatory measures from Washington. However, Ford later announced a temporary suspension of the surcharge following discussions with Commerce Secretary Howard Lutnick, adding to the uncertainty surrounding trade policies and market direction.

The Dow is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 30, suggesting the index might enter oversold territory.

Resistance level: 42000.00, 43000.00

Support level: 40730.00, 38680.00

Oil prices rebounded after initial losses, as markets feared that Canada could retaliate by restricting oil exports to the U.S. Given that Canada supplies 4 million barrels per day to American refineries, any disruption could push prices higher. However, this also raises inflationary concerns, which could further support gold demand as a hedge against economic instability.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 67.10, 71.10

Support level: 63.65, 60.45

Step into the world of trading with confidence today. Open a free PU Prime live CFD trading account now to experience real-time market action, or refine your strategies risk-free with our demo account.

Disclaimer

This content is for educational and informational purposes only and should not be considered investment advice, a personal recommendation, or an offer to buy or sell any financial instruments.

This material has been prepared without considering any individual investment objectives, financial situations. Any references to past performance of a financial instrument, index, or investment product are not indicative of future results.

PU Prime makes no representation as to the accuracy or completeness of this content and accepts no liability for any loss or damage arising from reliance on the information provided. Trading involves risk, and you should carefully consider your investment objectives and risk tolerance before making any trading decisions. Never invest more than you can afford to lose.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!