PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

In CFD trading, having solid strategies is essential for long-term success. Without a structured plan, trading can be like sailing without a compass. Weekly planning provides direction and focus, helping traders manage risks and adapt to market changes. It’s not just an administrative task but a strategic exercise that enhances trading skills and decision-making. This framework fosters informed decisions and disciplined risk management for traders.

* Effective weekly planning can greatly impact a CFD trader’s ability to handle market volatility.

* The choice of a CFD trading platform and broker plays a pivotal role in a trader’s strategy.

* A well-structured trading plan helps in making informed decisions for long-term profitability.

* Adopting a disciplined approach is key to achieving consistency in trading outcomes.

* Strategic planning is essential for managing risks and maximising trading opportunities.

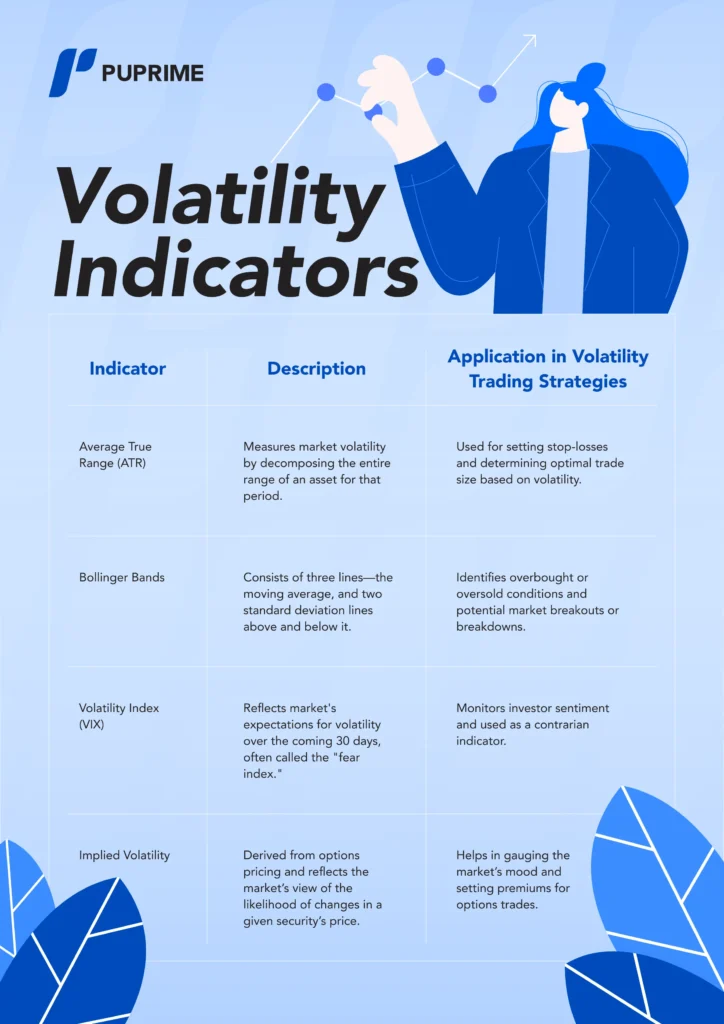

As a trader, dealing with market volatility is an inevitable part of the job. It’s not enough to simply recognize that the markets are volatile; successful volatility trading requires strategies that can filter through the noise and find opportunities. Among these, volatility trading strategies that use specific indicators are vital tools for any trader’s arsenal. These indicators are tailored to highlight market conditions conducive to entering and exiting positions and are an essential aspect of any volatility trading system.

Understanding and utilizing volatility indicators is essential to navigate through market volatility. These indicators serve as a compass in the often chaotic financial markets, helping traders discern the extent of market volatility and potentially predict future market movements. Below is a table of commonly used volatility indicators and a brief overview of how they can be incorporated into a trading plan.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!