PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

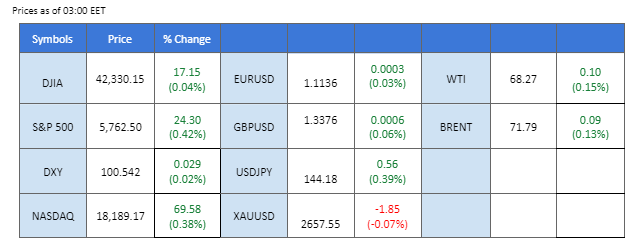

Market Summary

The U.S. dollar gained momentum following a hawkish statement from Fed Chair Jerome Powell, signalling that the Federal Reserve is not in a rush to accelerate rate cuts and is likely to maintain a quarter-point rate reduction in the near term. This boosted the Dollar Index (DXY), which rose over 0.5% in the last session, while Wall Street retreated due to concerns over the Fed’s hawkish stance.

Meanwhile, the euro faced downward pressure as inflation data from key Eurozone economies like Germany and Spain pointed to further easing, suggesting that the ECB might consider another rate reduction soon. Similarly, the Japanese yen, which had strengthened following the victory of Japan’s incoming prime minister, saw its gains ease in the previous session.

In the commodity market, gold struggled against the rising dollar, falling towards its weekly low. Oil prices remained lacklustre, with traders closely watching the escalating tensions between Israel and Lebanon, which could potentially drive prices higher in the near future.

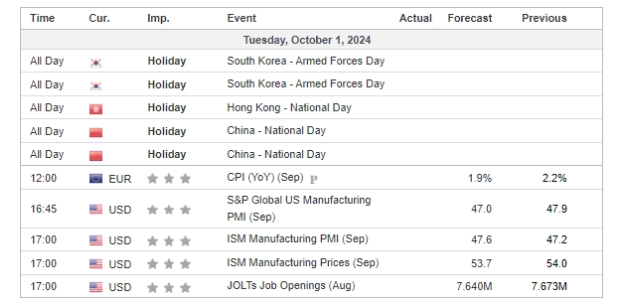

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index rebounded slightly after Federal Reserve Chair Jerome Powell alleviated concerns about a potential aggressive 50 basis point rate cut. Powell pointed to recent US economic data showing positive signs in both economic growth and personal income, reducing some of the downside risks that the Fed had previously highlighted. As a result, market participants are now pricing a 35% probability of a 50 basis point rate cut in November, down from 53%.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 100.95, 101.80

Support level: 100.25, 99.70

Gold prices retreated due to profit-taking and strengthening US Dollar, making dollar-denominated gold more expensive and dampening demand. Powell’s positive remarks on the US economic outlook further fueled the dollar’s rebound, causing gold prices to dip. The reduced likelihood of a 50-basis point rate cut also contributed to the bearish sentiment surrounding gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2640.00, 2665.00

Support level: 2620.00, 2610.00

The Pound Sterling eased slightly in yesterday’s session but continues to hold above its previous fair-value gap, indicating that it remains within its bullish trajectory against the U.S. dollar. The pair faced pressure from the strengthening dollar, which gained support following Jerome Powell’s hawkish remarks about the Fed’s cautious stance on rate cuts. Despite this, the Pound Sterling managed to offset some of the dollar’s strength, as the Bank of England’s (BoE) ongoing monetary tightening provided buoyancy for the currency, keeping it relatively firm.

The GBP/USD encountered strong selling pressure at below 1.3425, but the pair was also supported at above its previous fair-value gap at above 1.3350. A break from either side will give a clearer signal for the upcoming trend for the pair. The RSI is easing while the MACD is declining, suggesting the bullish momentum is softening.

Resistance level: 1.3440, 1.3520

Support level:1.3350, 1.3285

The EUR/USD pair has broken below its uptrend channel, signalling a potential bearish trend. The pair came under pressure from the strengthening U.S. dollar following Fed Chair Jerome Powell’s hawkish comments, which reinforced expectations of a slower pace in rate cuts. Additionally, the German and Spanish CPI readings indicated easing inflation, raising concerns that the European Central Bank (ECB) may further ease its monetary policy, which would likely weigh on the euro’s strength going forward.

The pair suggests a bearish signal, followed by a break below from the uptrend channel. A break below the critical support level at 1.1120 will be a solid bearish signal for the pair. The RSI has a lower-low pattern, while the MACD is on the brink of breaking below the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 1.1150, 1.1225

Support level: 1.1080, 1.1020

The Japanese yen, which previously strengthened due to the anticipated Prime Minister transition, has seen a sentiment shift, allowing the USD/JPY pair to rise by nearly 1%. Meanwhile, the U.S. dollar has also gained strength following the hawkish remarks from the Federal Reserve. However, the pair is encountering resistance near the 144.30 level. A break above this key level could signal a bullish breakout for the pair, indicating further upward momentum in the near term.

USD/JPY rose by nearly 1% in the last session from its recent low level. A break above the level at 144.30 may suggest a trend reversal for the pair. The RSI has a sharp rebound, while the MACD also shows signs of rebounding from the zero line, suggesting bullish momentum is forming.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

The US equity market closed higher on Monday, marking a strong finish to the third quarter. Investors remain optimistic about the possibility of further interest rate cuts, as Fed officials continue to signal the potential for more easing. The S&P 500 gained 0.3%, the Dow Jones rose 17 points (0.04%), and the NASDAQ Composite advanced by 0.4%. The S&P 500 is now up 5% for the quarter, rebounding after August 5 fall, sparked by recession concerns, which have since eased.

Dow Jones is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 42990.00, 44000.00

Support level: 41965.00, 40700.00

Bitcoin (BTC) is at a critical juncture, hovering near its key support level at $63,450. This level could serve as a potential turnaround point for BTC if it holds. The recent decline in BTC is believed to be linked to the strengthening of the Japanese yen, which raised concerns about the impact of the yen carry trade on global liquidity. However, the yen’s strength eased last night, and BTC’s consolidation in the last session suggests that the bearish sentiment around BTC has also softened. A rebound from this support level could signal a renewed bullish outlook.

BTC declined by more than 3% in the last session but has found support at near $63400 and may perform a technical rebound at such level. The RSI remains close to the oversold zone while the MACD is on the brink of breaking below the zero line, suggesting that BTC lacks bullish momentum.

Resistance level: 64780.00, 67540.00

Support level: 61210.00, 57060.00

Crude oil prices remained flat, reflecting the mixed market sentiment surrounding Middle East tensions and concerns over a pessimistic global economic outlook affecting demand. Prices were supported by fears that Iran may be drawn into a wider Middle East conflict as Israel escalates attacks on Hezbollah, Hamas, and Houthi forces—all backed by Iran. However, traders are uncertain whether China’s recent stimulus measures will be sufficient to bolster its weaker-than-expected demand for oil this year, casting doubts on the future of oil demand growth.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 49, suggesting the commodity might consolidate in a zone since the RSI stays near the midline.

Resistance level: 68.60, 70.30

Support level: 67.15, 65.60

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!