-

- Trading Platforms

- PU Prime App

- PU Copy Trading

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

Did you know that 80% of day traders give up within their first two months? This fact shows how tough day trading can be. At PU Prime, we’ve seen how avoiding common mistakes can change a trader’s path. Let’s look at eight key mistakes that often catch day traders off guard and how to avoid them.

* Success in day trading requires more than just a good platform

* Risk management is crucial for long-term trading success

* Emotional trading can lead to poor decision-making

* Proper preparation and strategy are essential for avoiding common pitfalls

* Continuous learning and adaptation are key to improving trading skills

Day trading can be rewarding but it can also be risky. At PU Prime, we know the challenges traders face. It is key to avoid common mistakes for long-term success. Good risk management in day trading can mean the difference between profit and loss.

Statistics show 85% of day traders fail due to over-trading, which cuts profits. But, traders who set clear stop-loss levels see 50% fewer losses. This emphasizes the need for discipline. The best place to day trade is where you can use strong risk management.

A solid trading plan is crucial. Traders with a good plan are 60% more likely to stay disciplined in volatile markets. This plan includes:

* Setting entry and exit points

* Defining risk tolerance

* Identifying market opportunities

Emotional trading is a big mistake. 70% of traders who chase losses fall into a downward spiral. By avoiding these errors, you can boost your day trading success chances. Remember, aim for steady profits, not quick gains.

Understand More About How You Can Get Started With Day Trading Strategies

Start Reading

Overtrading poses a significant challenge for day traders. It happens when traders execute too many trades in a short period, which can diminish their buying power and lead to substantial losses. It’s essential to be strategic about how often we trade.

Studies revealed that using one or two strategies can lead to 100 to 150 perfect trades in 200 days. This means aiming for one trade every two days is a good goal. Trading more can hurt our profits.

Frequent Transactions: Traders may engage in numerous transactions without a clear rationale or adherence to established trading plans.

High Turnover Rate: Excessive buying and selling of securities can lead to high transaction costs, potentially eroding profits.

Emotional Decision-Making: Choices influenced by fear of missing out (FOMO), greed, or frustration from losses, rather than by logical reasoning.

Over-trading can lead to significant financial losses and undermine long-term investment goals. Understanding the risks associated with over-trading and adopting effective strategies to mitigate them is crucial for maintaining sustainable profitability.

To avoid over-trading, we can:

* Stick to a trading plan

* Set daily trade limits

* Focus on quality trades, not quantity

Practising disciplined trading with a demo account with a top day trading platform as a beginner allows you to refine your skills without the risk of losing real money. This approach can be helpful in learning how to avoid over-trading.

Practise Day Trading With A Free Demo Account

Join Now

Day trading risk management is key to success. Many traders ignore this, leading to significant losses. At PU Prime, we stress the need for solid risk management to protect your money.

Limiting your risk is a central principle. Most pro traders limit themselves to risking only 1-2% of their account on one trade. This keeps your capital safe, allowing you to trade through the ups and downs.

Using stop-loss orders is also crucial. These orders close your trade if the market goes against you, capping losses. Take-profit orders lock in gains when the market is on your side.

It’s important to have a good risk-reward ratio. Aim for profits that are bigger than your losses. This way, you can stay profitable even with more losses than wins.

Choosing the right trading platform is also key. Look for platforms with strong risk management tools, live market data, and quick order execution. These features help you manage risk better in day trading.

Day trading strategies often fail when traders ignore market trends. Predicting market changes or trading against the trend can result in significant losses. Instead, successful day trading tips include identifying and sticking with market movements.

To spot trends effectively, traders should:

* Use technical analysis tools

* Understand market sentiment

* Stay informed about economic events

Learning to identify trends is key to day trading success. Adjusting strategies to fit market conditions reduces risks and boosts potential gains. Remember, news spreads fast online, affecting market trends. Skilled traders keep this in mind when trading.

End-of-day trading involves looking at price action from the previous day. This helps traders spot trends and make better decisions. By focusing on trend analysis, day traders can avoid ignoring market directions and improve their performance.

Day trading strategies are key to doing well in the fast-paced financial markets. A good trading plan acts as your guide to making money. Without it, you’re trading without a clear path, which is risky. Up to 99% of day traders fail to generate sufficient income, highlighting the importance of a solid plan.

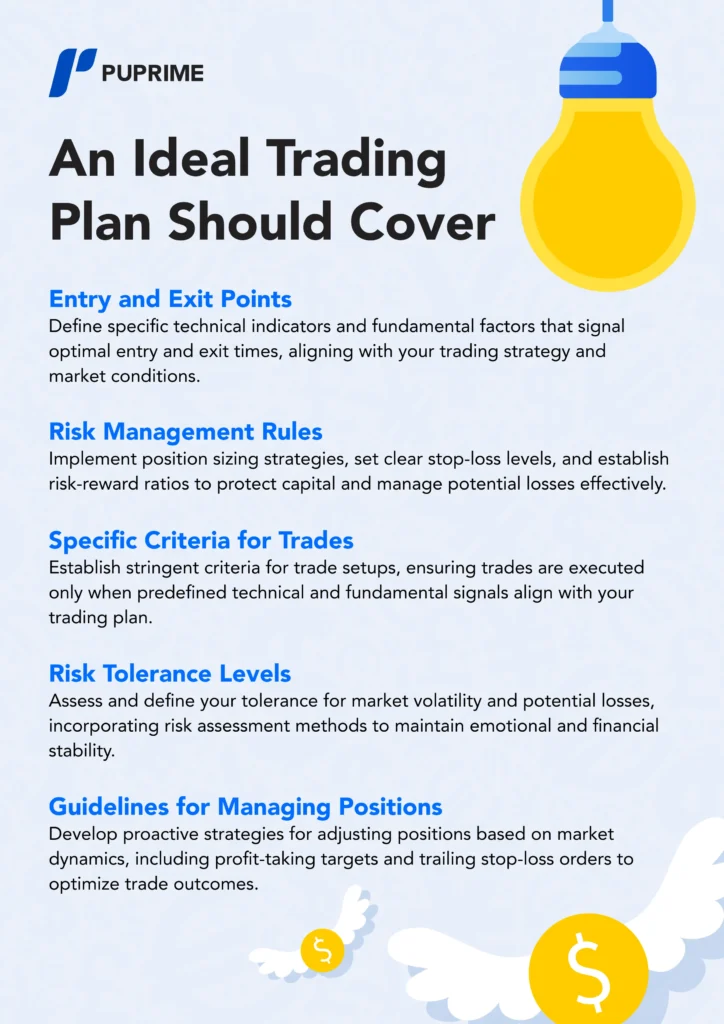

Your trading plan should cover:

Entry and Exit Points: Define specific technical indicators and fundamental factors that signal optimal entry and exit times, aligning with your trading strategy and market conditions.

Risk Management Rules: Implement position sizing strategies, set clear stop-loss levels, and establish risk-reward ratios to protect capital and manage potential losses effectively.

Specific Criteria for Trades: Establish stringent criteria for trade setups, ensuring trades are executed only when predefined technical and fundamental signals align with your trading plan.

Risk Tolerance Levels: Assess and define your tolerance for market volatility and potential losses, incorporating risk assessment methods to maintain emotional and financial stability.

Guidelines for Managing Positions: Develop proactive strategies for adjusting positions based on market dynamics, including profit-taking targets and trailing stop-loss orders to optimise trade outcomes.

Knowing the best place to day trade means having a clear strategy and sticking to it. Being consistent is vital. New traders often set tight deadlines for profits, which adds stress. Remember, trading well takes patience and ongoing learning.

At PU Prime, we emphasise the importance of regularly checking and fine-tuning your plan. This keeps you disciplined and objective, even when markets are unstable. With a detailed trading plan, you’re ready to handle market changes and make smart choices.

Emotions can significantly affect our day trading decisions. Fear, greed, and anger often lead to quick, impulsive actions. These actions can result in significant financial losses. Traders sometimes make quick decisions to get back into the market for past losses.

This emotional rollercoaster can make us stray from our trading plans. To avoid this, it’s best to stick to your strategies and use stop-loss orders. These tips can help manage risks and stop emotional decisions. Remember, even the best platforms can’t shield you from your emotions.

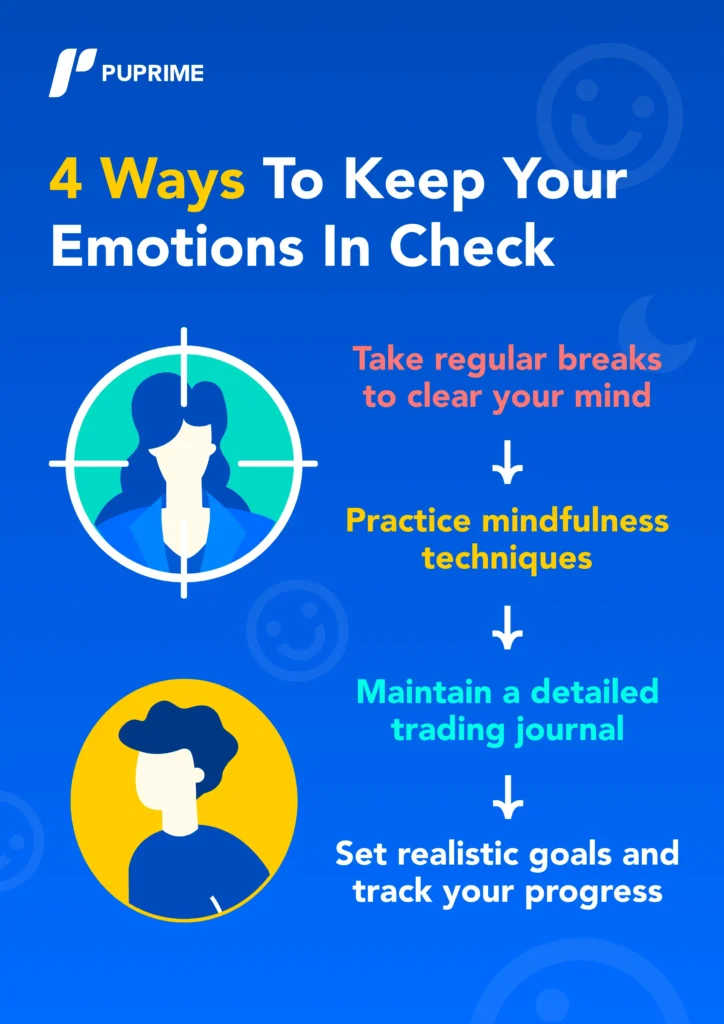

Here are some ways to keep emotions in check:

* Take regular breaks to clear your mind

* Practice mindfulness techniques

* Maintain a detailed trading journal

* Set realistic goals and track your progress

At PU Prime, we know the mental challenges of day trading. That’s why we offer resources to help you build a strong trading mindset. By focusing on your long-term goals and adopting a structured approach, you can minimise the impact of emotions on your trading.

Overleveraging is a considerable risk in day trading. It can lead to huge losses. For example, Barings Bank went down after losing £800 million from risky bets. Another example is Long-Term Capital Management (LTCM), which lost over $4 billion because of leverage.

Day trading’s buying power can be both good and bad. It allows traders to control more with less money, but it also increases the risk of significant losses. Many brokers offer up to 1:2000 leverage, but this is risky for most traders. We suggest starting with lower leverage and slowly increasing it as you get more experience.

To manage leverage well:

* Know your risk level

* Use stop-loss orders to control losses

* Keep enough money in your account to avoid margin calls

* Don’t risk more than 1-2% of your portfolio on one trade

The best trading platform for day traders should have tools for managing leverage and risk. At PU Prime, we offer educational tools and risk management features. Remember, successful day trading is about keeping your money safe and making steady profits, not taking too many risks.

Learn About Trading With PU Prime’s Resources

Start Reading

Day trading needs a mix of market analysis. Fundamental analysis examines economic indicators and company finances that influence prices, whereas technical analysis utilises charts and indicators to identify trading opportunities. Neglecting either of these approaches can significantly impact trading outcomes, exposing traders to increased risks and missed profit potential.

Fundamental analysis involves evaluating the intrinsic value of a security by examining underlying economic, financial, and qualitative factors. These include:

Economic Indicators: Assessing GDP growth, inflation rates, and employment data to gauge financial health and potential market trends.

Company Financials: Analysing revenue, earnings, debt levels, and management performance to determine the financial strength and growth prospects of a company.

Industry Trends: Identifying sector-specific factors such as regulatory changes, technological advancements, and consumer demand shifts that can impact stock prices.

On the other hand, technical analysis focuses on historical price data and trading volume to forecast future price movements. Key aspects include:

Chart Patterns: Identifying patterns such as head and shoulders, triangles, and double tops/bottoms to predict potential price reversals or continuations.

Indicators and Oscillators: Using tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to measure market momentum and overbought/oversold conditions.

Support and Resistance Levels: Identifying key levels where prices are likely to pause or reverse, providing opportunities for entry or exit points.

While technical analysis provides valuable insights into market psychology and short-term trading opportunities, neglecting fundamental factors can lead to trading decisions that are not grounded in broader market fundamentals. Ignoring economic data releases or corporate earnings reports may result in missed opportunities or unexpected losses.

In conclusion, neglecting either fundamental or technical analysis can limit a trader’s ability to make informed decisions and navigate market uncertainties effectively. By embracing a comprehensive analysis framework and staying informed about both macroeconomic trends and price dynamics, traders can enhance their trading proficiency and capitalise on diverse market opportunities.

Understand The Importance Of Technical Analysis

Start Reading

Understand The Importance Of Fundamental Analysis

Start Reading

Day trading isn’t a quick way to make money. It takes time, patience, and hard work to get good at it. We’ve looked at common mistakes that can trip up even skilled traders. By avoiding these errors, you can increase your chances of doing well in this challenging field.

By staying disciplined and avoiding behavioural mistakes like overtrading, making emotional decisions etc, you’ll be better prepared to handle the ups and downs of day trading.

Open A Live Account With PU Prime

Join Now

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!